Core Central Region (CCR) condos are an interesting investment: it’s said these days that people don’t invest in them to get rich. Rather, they have to get rich first, and then invest in them. After all, you could fund a coup in a small country, for the cost of a shoebox flat in District 9, 10, or 11. But have these investments really made money over the past decade?

A game-changing decade for Singapore’s property market

2009 to 2019 has been a game changer. It’s been a wild 10 years, consisting of:

- A Global Financial Crisis in 2008/9 that saw interest rates plummet to record lows, so that bank loans are cheaper than even HDB loans

- A slew of cooling measures that kept intensifying, from 2012 to the present

- An oil price slump in 2014, that punched a gaping hole in the belief that high-end property maintains demand even in downturns

- Dramatic price pick-ups in former “ulu” areas, as Singapore decentralises; such as an EC in “cheap” Punggol that’s reaching $1,052 per square foot

- A weak rental market, that’s put an end to the dream of the “property paying for itself”

- The end of seeing a flat as an investment, and the creeping reality of lease decay

- Brexit, a US-China Trade War, and a rise in protectionism that’s playing havoc with the Singapore economy

We could go on, but you get the picture: it’s time to revise our long-held assumptions, in the face of big changes. And the first of these we’re addressing is Core Central Region (CCR) properties, a long-time darling of Singapore’s real estate market.

Quick summary:

- Rental yields are lower for many CCR condos (around 1.8 to two per cent)

- Rental income for CCR condos have mostly moved in tandem with the overall decline

- Mass market condos have appreciated better, but mainly because of cooling measures rather than a lack of demand

- CCR condos did recover faster after the last financial crisis though, and it might happen again

What are prices in the CCR like today?

Today, the typical price of a CCR condo (i.e. a condo is districts 9, 10, and 11) averages $2,247 per square foot. The average total price is about $3.17 million, with the majority of units being about 1,400 square feet (three to four bedrooms).

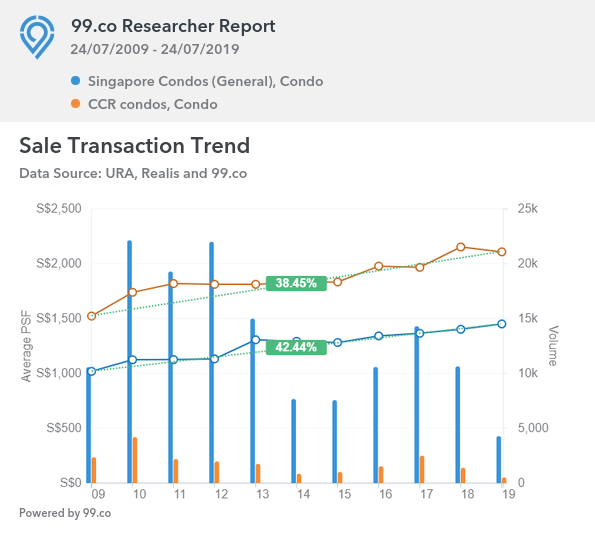

Using 99.co data, we pulled up a comparison of how the prices look now, compared to 2019:

Between 2009 to 2019, the average price of CCR condos rose 38.45 per cent. This is below the performance of private non-landed properties island-wide (excluding Executive Condominiums), which stands at 42.44 per cent.

But there are two details of note:

First, if you go back just one year, CCR condos were actually starting to outperform the overall condo market. But CCR prices took a sharp fall after July 2018, when the government raised the Additional Buyers Stamp Duty (ABSD) for foreigners to 20 per cent (it was previously just 15 per cent).

Higher ABSD impacts CCR condos more than mass market condos. It dissuades the foreign buyers, who make up a significant portion of this property segment (based on our data, close to 41 per cent of CCR properties are owned by foreigners). Also, many CCR properties – roughly half as of 2016 – are bought by investors rather than owner-occupiers.

While a true home owner may not be dissuaded by the ABSD (they are buying for personal use, not for rental yield or capital gain), investors are. Even Singapore citizens face ABSD rates as high as 12 per cent for the second house; at that rate, investors may decide they’re better off buying into some other asset class.

Second, CCR properties fared much better in the aftermath of the financial crisis

In the immediate aftermath of the financial crisis, CCR prices rose much faster compared to the overall condo market. In the period between 2009 to 2012, CCR prices picked up by around 20.4 per cent, whereas the overall condo market lagged behind at around 16.7 per cent.

Some of the analysts we spoke to attribute this to the “safe haven” effect – when markets are in turmoil, some investors turn to Singapore real estate as it’s seen as a stable place to park their money (e.g. conventional stock and bond markets were both in turmoil in 2009, causing many to re-invest in real estate).

It also helped the US Federal Reserve lowered interest rates to stimulate the economy. This sent home loan rates in Singapore to record lows, and in 2009 it was quite possible to find interest rates below one per cent per annum. This further increased the attractiveness of non-landed private property.

So while CCR condos have under-performed the general condo market over the past decade, we can note that:

- CCR condos can win out in the aftermath of an economic downturn, which is precisely the kind of situation Singapore faces now and in 2020

- There is a strong fundamental demand for CCR properties; stronger than the actual numbers suggest. It’s policy intervention (cooling measures), rather than lack of demand that’s driving prices down

What’s happening on the rental front?

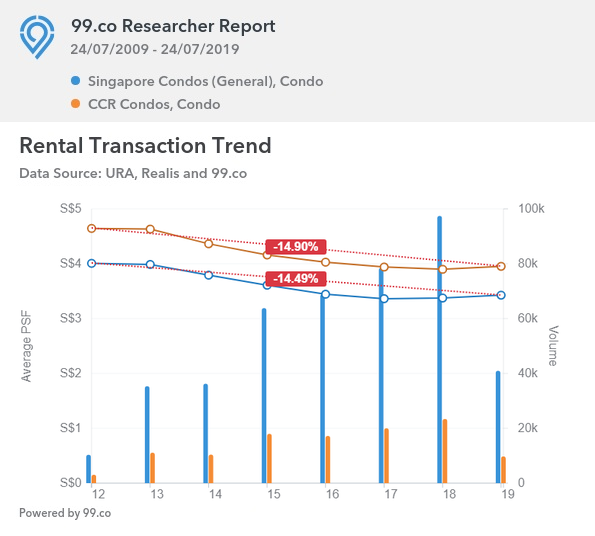

Singapore’s rental market is soft at the moment, with rental transactions in the CCR moving in tandem with the overall market.

Average rental rates in the CCR are about $3.95 psf, down from $4.64 a decade ago. In terms of average price, CCR condos are fetching about $4,954 per month, down from $6,129 a decade ago. This is a 14.9 per cent decline.

In the overall condo market, rental rates have fallen from about $4 psf, to about $3.43 psf. Average rental rate for a condo in Singapore is now about $3,500, down from $4,680 a decade ago.

Average rental yield for a CCR property now ranges between 1.8 to two per cent, notably below the 2.3 to 2.5 per cent average for the overall condo market. But this won’t be a surprise to investors in high-end properties, who know they’re buying at a premium.

So, are CCR properties still a good investment?

CCR properties are not a bad investment; but they may be a victim of their own, highly successful marketing machines. It’s time that investors temper their expectations, against the oft-exaggerated sales pitches used to push CCR developments.

We can see, for example, that CCR condos weather the weak rental market only a little bit better than than mass market counterparts (about half a percentage point). This casts doubt on the old marketing spiel that CCR condo rents are “recession resistant” due to prime location.

Investors should also be strict on the numbers and blind to the glamour – there may be condos in less prestigious regions that nonetheless present better investment prospects.

Investors who believe in Singapore real estate as a safe haven should also keep watch. CCR properties surged ahead in the aftermath of the last financial crisis; and with the US facing growing pains in its trade war (and the Fed again freezing or potentially cutting interest rates), we could see a repeat performance.

Would you invest in a CCR condo today? Voice your thoughts in our comments section or on our Facebook community page.

Looking for a property? Find the home of your dreams today on Singapore’s largest property portal 99.co! You can also access a wide range of tools to calculate your down payments and loan repayments, to make an informed purchase.