Here’s a bombshell for anyone who might be selling their property: Even if you sell for a profit, you could still end up with a loss or even land yourself in debt instantly. When you owe money after selling your property, you’ve made what’s called a negative sale.

That’s a scary situation to find yourself in, so you need to know what could cause a negative sale. In a recession (i.e. right now), we’re likely to see more cases of negative sales happening, since some sellers may lower their prices (e.g. to below market value) to find a buyer.

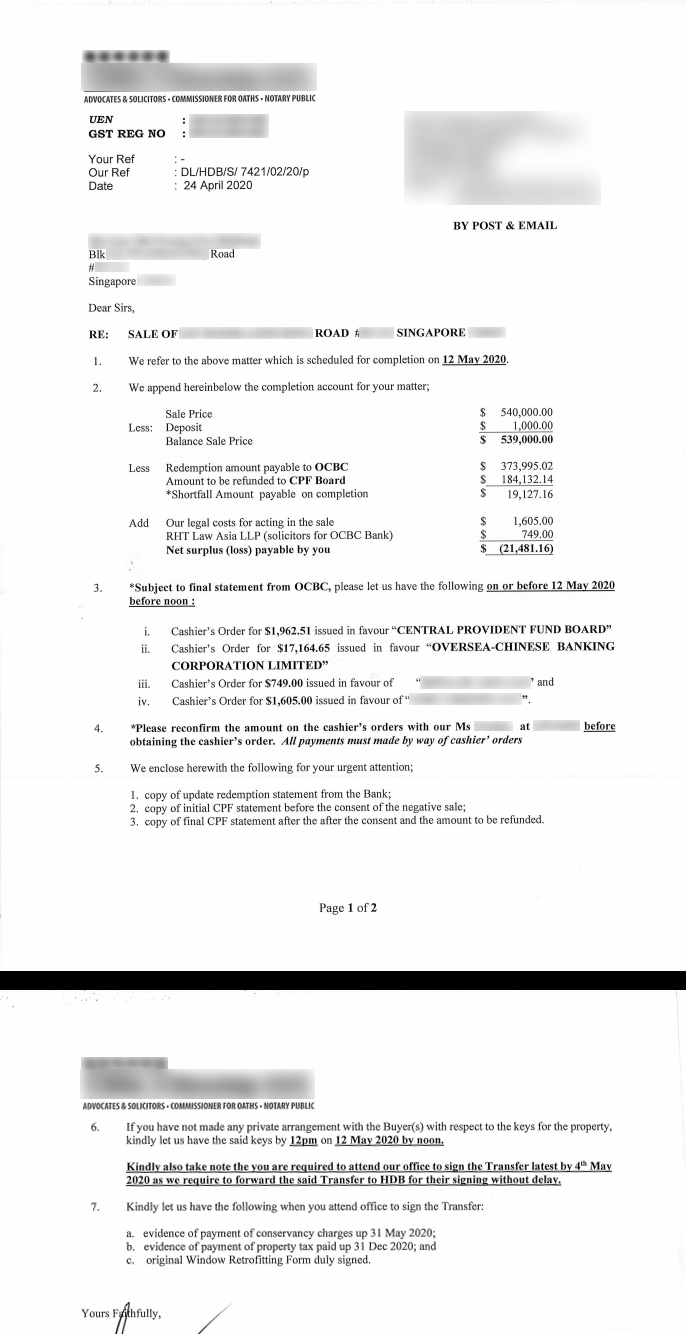

Imagine that a seller urgently needs the cash and thinks he/she has managed to sell at a profit, but then get rude shock when the conveyancing lawyer comes back with a list of debtors (e.g. the bank) that must be repaid by completion date of the sale, failing which he/she could be sued by the buyer for not being able to handover.

It gets even worse if the seller had already committed to another property purchase and has to forfeit deposits and/or downpayment paid.

How do you avoid falling into this dark abyss?

First, you’ll have to understand the different ways you can end up with a negative sale:

- Outstanding loan amount after interest

- Sellers Stamp Duty and other fees

- Having to pay accrued interest back into your CPF account

- You’re in arrears to the same bank

1. Outstanding home loan amount after interest

Your home loan isn’t free—it’s subject to compounding interest. The interest is computed at the start of your mortgage and, together with the principal (i.e. the amount that actually pays off your property), forms the total outstanding amount you need to pay over the course of your tenure.

If your sale price can’t beat the amount still outstanding at the time of your sale, then boom, you’ve made a negative sale.

Here’s an example: You borrow $1 million for your property. The loan interest is 2% per annum with a 30 year tenure. Factoring the interest, the total amount you need to pay back is roughly $1.33 million. A total of $330,000+ consists of interest payments alone.

After five years, you decide to sell the property. Your outstanding loan amount would still be more than what you intially loaned, about $1.108 million (25/30 x $1.33 million).

If you sell your property at anything below that amount, even for a $50,000 “profit”, you’ve made a negative sale and will owe the back about $58,000. (And that’s not counting any early repayment fees you might have to incur.)

If you’re not sure of the numbers, consult your bank before you set a sale price. At the very least, your sales proceeds should at least pay off the entire mortgage with the interest.

This is why it’s important to keep home loan interest rates as low as possible, and refinance when the rates climb too high. Private bank loans fluctuate all the time, from as low as 1.3% (at the time of writing) to as high as 3%; although the average is about 1.8%.

For HDB loans, the interest rate is always 0.1% above the prevailing CPF rate. It has been set at 2.6% for nearly two decades and counting; and seldom changes.

2. Seller’s Stamp Duty (SSD) and other fees

If you sell a property within three years of buying it, you will incur the Seller’s Stamp Duty (SSD). This is a percentage of the sales proceeds that will incur SSD:

- 12% if sold within the first year of purchase

- 8% on the second year of purchase

- 4% on the third year of purchase

Having to pay the SSD, plus the home loan interest and other fees can result in a negative sale, especially for a seller who has little choice but to sell soon after he/she bought the property.

Furthermore, it’s highly unlikely for any property to appreciate so fast in three years that you can still see profits after paying the SSD. (Since 2005, the annualised return on most condo properties in Singapore is about 3.44%, excluding rental gains).

The SSD is still payable in the event of an en-bloc sale (so it’s sometimes out of your control). But you can at least appeal to the Strata Titles Board (STB) if the SSD would cause you a financial loss in the case of a collective sale.

Besides the SSD and outstanding home loan amount, again bear in mind other fees such as:

- Prepayment penalties from the bank (if this clause applies, you need to pay 1.5% of the amount you’re prepaying to end the home loan early)

- Agent service fees (most property agents take 2% of the transaction amount as their commission or fee)

- Conveyancing and processing fees (varies)

The total impact of all the smaller fees, coupled with interest rates or SSD, can result in a painful negative sale.

3. Having to pay accrued interest back into your CPF account

Of all the things that could result in a negative sale despite a profit, this has got to be the most controversial.

After all, our CPF funds are supposed to help us own a home in the first place, but the truth is that it can really come back to bite us, hard.

When you sell your property, not only must the funds you used from your CPF Ordinary Account (CPF-OA) be returned to it, you’ll still need to pay an EXTRA 2.5% interest. The interest kicks in once you use that sum of money. For example, a housing grant of $50,000 given to purchase a HDB flat will be $56,570 you have to put back to your CPF-OA five years later, if you sell.

That interest called the accrued interest, which is the interest amount that you would have earned if your CPF savings had not been withdrawn for housing. (We’ve covered accrued interest in detail in this article.)

According to CPF, if you sell your property at or above market value, you only have to pay back accrued interest in the case of positive cash proceeds. Once your cash proceeds hits zero, you’re exempt from actually owing CPF the money for accrued interest.

We must repeat: You’ll only get that ‘pardon’ if you sell your property at or above market value.

This means that, sellers who have little choice but to sell below market value, or belatedly find out that their sale price is below market value, will suddenly find themselves being in debt to CPF.

Yes, that organisation that so generously gave you the funds you needed for your home will turn on you like a shark, giving you a matter of weeks to return the outstanding accrued interest in a lump sum payment, by the completion date of your sale.

It gets worse if you used your CPF-OA monies to pay your home loan installments, because that accrued interest is effectively interest ON TOP of interest.

In the ultimate worst case scenario, you risk suddenly owing tens of thousands to the bank and CPF Board at once, even if the sale amount of the property is higher than what you bought it for.

The only consolation is that you can find out the amount you owe CPF plus accrued interest at any point in time, by logging onto your CPF account via the organisation’s website.

4. You’re in arrears to the same bank

If you have other loans to the same bank holding your mortgage, then the bank really can grab at the proceeds to cover your other debts. Most banks we called didn’t want to get into details, but we confirmed two things:

First, banks do actually have a right to take money this way (it’s often written right into the terms of the loan). If you’re in arrears and the money appears in your account with them, they can just reach out and grab it—it’s literally right there in their coffers.

Second, we were told this is only done if you’re seriously in arrears (e.g. you’ve owed the money for years and have repeated lawyer letters from them), or have a history of defaults plus outstanding debts. If you have a good history of repaying your credit card, personal loans, etc., on time, they will likely not resort to this even if you have outstanding debt.

Note that on selling a property, the money will be used to pay off any bad debts with the bank first, before the rest of it is used to repay the outstanding home loan. If the seller owe the bank substantial sums, like tens of thousands of dollars in credit card debt, this could leave him/her owing money even after selling the property at profit.

How do I avoid being in debt from a negative sale?

One way to avoid the potentially devastating effects of a negative sale is to service as much of your loan in cash as you’re financially comfortable with, instead of CPF funds. For example, some homebuyers use their CPF monies only for the downpayment of the property, but pay the loan in cash. This way, they only pay back the downpayment with accrued interest when they sell their property.

Some buyers also avoid using CPF grants, as they want to minimise the amount they need to pay back.

In addition, homeowners should keep a close eye on the interest rates they pay (something that happens by default if you pay in cash instead of CPF funds; when you need to fork out money every month or quarter, there’s no way you’ll forget how much you’re paying!) It’s also important to refinance when appropriate, or reprice your loan with the same bank. Always compare to find the cheapest loans.

For HDB flat owners in particular, lower interest rates are why some choose bank loans over HDB loans. The danger is that bank loans come with early repayment penalties (a HDB loan doesn’t) and banks may pursue a court order against you (to force you to sell your home) if you are unable to service your mortgage, or are in serious arrears with the same bank.

HDB, on the other hand, allows some leeway in late payment of home loan installments and are far less likely to foreclose your property and leave you without a home.

Finally, keep your debts under control. If you must have credit card or personal loan debts for some reason, be wary of having a home loan with the same bank you owe all that money to.

Always do a thorough financial assessment prior to selling your home to ascertain if you might make a negative sale. A financial consultant, which may be your property agent, can assist you in this.

Are you facing the prospect of a negative sale? Voice your thoughts in our comments section below.

If you found this article helpful, 99.co recommends What does Bala’s Curve tell us about leasehold property value? and 5 ways selling your property can go horribly wrong (and how to fix it)

Looking for a property? Find the home of your dreams today on Singapore’s largest property portal 99.co! You can also access a wide range of tools to calculate your down payments and loan repayments, to make an informed purchase.