Regular readers will know my feelings towards cashback cards, but UOB has just unveiled something that’s made me sit up and take notice.

| UOB Absolute Cashback Card |

| I’m checking with SingSaver whether they plan to offer this card, and if so, what the sign-up reward is. You might want to hold your fire for now. |

Today marks the launch of the new UOB Absolute Cashback Card, which carries a simple premise: 1.7% cashback, with no cap, no minimum spend, and no spend exclusions.

Yes, you read that right- no spend exclusions.

UOB Absolute Cashback Card: Overview

| Min. Income | Annual Fee |

| S$30,000 per year/ S$10,000 fixed deposit | S$192.60 (first year free) |

| Terms & Conditions |

|

The UOB Absolute Cashback Card has an entry-level S$30,000 per year income requirement, and a S$192.60 annual fee (waived for the first year). Cardholders earn 1.7% cashback on all transactions, with no minimum spend or cap.

First things first. A cashback rate of 1.7% would make the UOB Absolute Cashback Card the highest earning no-minimum-spend cashback card on the market, period.

But what’s even more incredible is the prospect of no spend exclusions. I mean, I give UOB a lot of grief for being tricky with their T&Cs (have you seen the latest changes to the KrisFlyer UOB Credit Card?), so it’s only fair to acknowledge when they go the other way.

And go the other way they have. UOB is hammering home the idea of no spend exclusions, making it clear that any merchant which accepts American Express payments will be eligible. As per the FAQ:

|

Q2. What transactions are eligible for cashback? Transactions at all merchants who accept American Express credit card payments are eligible for cashback. However, it does not include NETS and NETS-related transactions, 0% Instalment Payment Plans, SmartPay, Personal Loans, balance/funds transfers, cash advances, any fees and/or charges (including without limitation, late payment charges, interest charges, annual or monthly fees or charges, service fees or processing fees) imposed by UOB. |

Heck, UOB even explicitly suggests some categories which you could try :

- Insurance

- School fees

- Wallet top-ups

- Healthcare

- Utilities & telco bills

- Rental

And yes, before someone asks, GrabPay top-ups will earn cashback too. That’s an important point, mind you- some may be lamenting the fact the UOB Absolute Cashback Card is on the American Express network, which limits its merchant acceptance.

But all you have to do is top-up your GrabPay wallet with the UOB Absolute Cashback Card, and then use the GrabPay Mastercard to spend. You’ve effectively “converted” an AMEX into a Mastercard, gaining access to a wide range of merchants and still earning 1.7% cashback in the process.

| ⚠️Note: Before you get too excited, remember that AXS machines don’t accept American Express, nor the GrabPay Mastercard |

This basically allows you to save 1.7% on transactions where miles and points can’t be earned, and while that won’t be lifechanging, it’s better than walking away empty-handed.

While “no exclusions” is certainly headline grabbing, I can’t help but think that sooner or later, some qualifications will need to be added. No doubt the hivemind is already hard at work trying to figure out MS opportunities.

UOB Absolute Cashback Card: Other Perks

No exclusions would be sweet enough, but there’s two other perks that caught my eye. Scroll down on the landing page and you’ll see a link for FoundersCard and Tablet Plus.

6 months complimentary FoundersCard membership

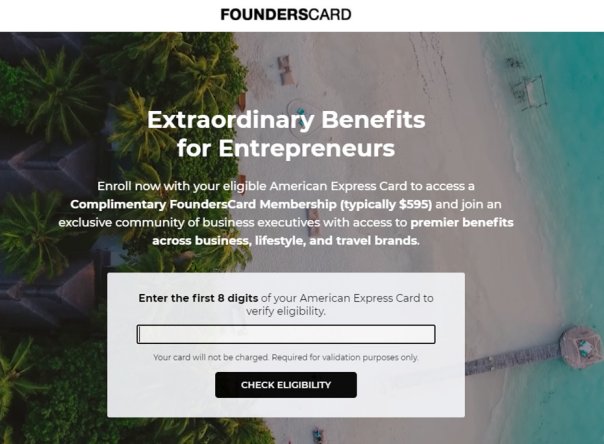

FoundersCard is a membership positioned at small business owners and entrepreneurs, though any frequent traveler is likely to find the benefits useful.

This usually costs US$595 a year (although there’ a ton of promo codes on blogs and such that reduce the fee to US$395), but selected American Express cards can enjoy a 6-month complimentary membership.

I tried my AMEX Platinum Charge, AMEX Platinum Reserve, AMEX SIA Business Card and AMEX KrisFlyer Ascend and they all didn’t work, which leads me to think this offer isn’t for American Express issued AMEX cards.

At the same time, however, it’s definitely not a UOB Absolute Cashback Card exclusive. I managed to get it working for my UOB Preferred Platinum AMEX, and I’d welcome data points from anyone with the UOB PRVI Miles AMEX, DBS Altitude AMEX, or any other bank-issued AMEX for that matter.

FoundersCard offers a wide range of airline, hotel and business benefits, but the key one I’m interested in is complimentary elite status. Members receive:

- Caesars Rewards Diamond

- Hilton Honors Gold

- Marco Polo Silver

- Sixt Platinum

| 👍 Even though the free FoundersCard membership is 6 months, your abovementioned status should be valid for 1 year |

Yes, Hilton Honors Gold, which gives you free breakfast at Hilton properties worldwide- whether you’re at the Hilton Garden Inn Serangoon, or the Waldorf Astoria Maldives. That’s an incredible perk to have, and one that everyone should snap up ASAP.

I’ll probably do a separate article about this, so stay tuned.

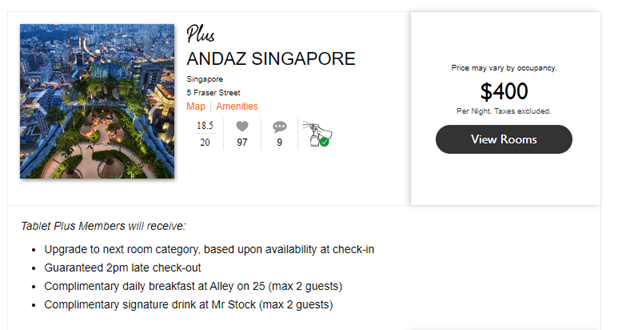

Two year complimentary Tablet Plus membership

I’m less familiar with Tablet Hotels, but it’s an OTA which brands itself as the MICHELIN Guide for hotels. They offer a Tablet Plus membership for US$99 a year, with benefits such as:

- Guaranteed early check-in

- Guaranteed late check-out

- Free breakfast

- Hotel credits

- Airport transfers

- Valet parking

- A welcome gift

Selected American Express cardholders (including the UOB Absolute Cashback Card) receive a complimentary two year Tablet Plus membership. Again, this isn’t a UOB Absolute Cashback Card specific perk, but it’s certainly interesting nonetheless.

The list of benefits is impressive, but it’s important to remember that not all of them will apply across all properties. What’s more, the local selection is quite sad. I did a search for Singapore, and the only property offering Tablet Plus benefits was the Andaz Singapore.

Other geographies fare slightly better- in Hong Kong there were five, Bangkok had six, Bali had 20.

UOB Absolute Cashback Card: Welcome Bonus

From 4 May to 31 July 2021, new-to-bank cardholders who get approved for a UOB Absolute Cashback Card will earn 5% cashback on their first S$3,000 spend.

| ❓ UOB defines “new-to-bank” as those who do not hold any principal UOB credit cards now, or in the 6-month period prior to 4 May 2021 |

The 5% cashback consists of:

- the base 1.7% cashback

- a bonus 3.3% cashback on the first S$3,000 of spending

The maximum bonus cashback that can be earned is capped at S$99, so you’ll want to spend S$3,000 on the dot. Bonus cashback will be credited by 15 October 2021.

What’s even more incredible (for UOB, at least) is that there’s no cap on the maximum number of eligible customers. So long as you sign up and meet the eligibility criteria, you’ll get your bonus. The full T&Cs of this offer can be found here.

As mentioned earlier, I’m checking with SingSaver whether they plan to offer any additional gifts for sign-ups; if you don’t have a pressing need for the card, you might want to hold off for a couple of days.

Conclusion

While it’s not going to make me abandon miles collecting, I can certainly see a lot of good use cases for the UOB Absolute Cashback Card. I’m all for taking a 1.7% discount on my insurance premiums, government payments and other transactions that usually run afoul of bank exclusion lists.

In fact, I’m actually surprised American Express agreed to go ahead with this, given how it has the potential to cannibalise their AMEX True Cashback Card. I suppose the belief is that a 0.2% difference won’t lead to a whole lot of switching behavior, but I don’t know- it is psychologically important, even if the actual difference is marginal.

What’s your take on the new UOB Absolute Cashback Card?